|

|

Minister Phil Hogan, what in the name of God have you started?

The deadline of September 30th 2014, given to County Councils by the Revenue Commissioners to vary property tax charges by 15%, at the behest of the Revenue Commissioners, has given the search for ‘Urban/Rural Funding Equalisation Debate’ a now much more added urgency.

Publicity shy Dublin Labour TD Kevin Humphreys; yes him who recently confronted that unfortunate rat, as it scurrying across the polished floors of Leinster House, warns he will become ‘rebellious’ (God forbid Kevin, control yourself, you will have us all protesting) if central funds for local authorities are diverted from councils in his thriving Capital City of Dublin, to be spent in “Hillbilly Country”, latter also referred to in EU dispatches, (strictly in the interest of political correctness you understand) as “Rural Ireland.”

Mr Humphreys is seriously losing sleep about critically important local issues in Dublin, now much in need of urgent funding. It appears from press reports that the government could redirect funds to rural, less well populated areas in our State; due to the excessive property tax yields in Dublin. This government decision could see Mr Humphreys turn savage, especially since these rural voters have been less than sympathetic to Labour Party policies, in recent local elections.

Dublin’s Moving Statues

I myself, a well known rural Co Tipperary blow-in, can partially understand where Humphreys ( Latter no relation to character in satirical British sitcom “Yes Minister”) is coming from, particularly in relation to the necessary funding of items like the “Moving Statues” of Dublin. Please allow me to further elaborate.

Statues of Viscount Gough & Molly Malone I believe it was Jury’s Hotel, Dublin that financed the statue of the fictional 17th century, third generation, double jobbing, fishmonger (by day) and part-time prostitute (by night) “Molly Malone.” Molly Malone, of that well-known ballad of the same name has become the most recent of Dublin’s moving statue; “shifted” (Please interpret latter word using a biblical understanding) from the bottom of Grafton Street to be possibly relocated temporarily on Andrew Street.

The statue affectionately known by Dublin natives as “The Tart with the Cart”, “The Dish with the Fish”, “The Trollop with the Scallops” and “The Dolly with the Trolley”, has just cost the Irish tax payer €50,000 for its recent removal, it’s cleaning, repairs etc.. Happily the €50,000 spent should see visitors not noticing any change in her newly welded appearance when she once again appears back ‘on the town’ at her new temporary location outside the tourist office now established in the former St Andrew’s Church on nearby Suffolk Street.

This statue will of course incur further costs later, pending the end of Luas works in 2017, when she will be again relocated to her former ‘beat’ on Grafton Street, slightly north of her more recent location.

The repairs to the Molly Malone statue were necessary, because of cracks brought about by tourists sitting on her. How do I know this? Take a look at the tourism facts & figures for the Top Ten free attractions in Ireland for 2013.

Tourism Facts

Note that No 1. on the list of Tourism attractions was The National Gallery of Ireland, Dublin (641,572), followed by No 2. The National Botanic Gardens, Dublin (550,000), No 3. Farmleigh House, Dublin (435,476), No 4. National Museum of Ireland, Kildare Street, Dublin (404,230), No 5. Newbridge Silverware, Kildare (350,000), No 6. Science Gallery, Trinity College Dublin (339,264), No 7. National Museum of Ireland, Natural History, Dublin (284,323), No 8. The National Library of Ireland, Dublin (260,152), No 9. National Museum of Ireland, Collins Barracks, Dublin (251,226) and finally No 10. Chester Beatty Library Dublin (250,659) and all but one have got the same thing in common.

It is also interesting to note the tourism facts & figures for five of the top ten paid-for attractions in 2013, namely:- The Guinness, Storehouse, Dublin (1,157,090), National Aquatic Centre, Dublin (858,031), Book of Kells, Dublin, (588,723), St. Patrick’s Cathedral, Dublin (410,000) and Kilmainham Gaol, Dublin (326,207) have also all got one thing in common.

So have you spotted how Molly got cracked? Yes correct, fourteen out of the fifteen top Irish Tourist attractions hold a Dublin City address. These over abundant tourists now visiting Dublin are no better than street vandals; sitting as they do under Molly’s ample semi-bared blossoms, to have their photographs taken. These unprofitable tourists have being encouraged to visit Dublin, through the spending of millions of Euro by Fáilte Ireland, attracting them only to Dublin city over the last five years, to the detriment of unfunded rural Ireland and Co Tipperary in particular.

Continue reading Hidden Tipperary Aware Of Current Urban Tourism Greed

“People with big appetites, should not expect to fill their bellies in someone else’s fridge.” Quote from Judge Judy.

Local Elections 2014 – A Quick Guide Before Polling Day

Voting Day: Voting will take place on Friday May 23rd next 2014.

June 1st Environment Minister Phil Hogan’s new Local Government Reform Bill will come into being and will represent a new, primary overhaul of our local political system, which to-date is some 116 years old.

Tipperary as a county has been divided up into five electoral areas as follows; Nenagh (9 seats), Templemore/Thurles (9 seats), Tipperary/Cashel (7 seats), Clonmel/Cahir (9 seats) and finally Carrick-on-Suir/Fethard (6 seats). In Co Tipperary therefore this present government will create 40 new jobs in total. As shown the Local Electoral Area of Templemore/Thurles, will offer nine new jobs/posts each with a five-year long contract.

Looking back down through the years, most historians will agree that the year 1898 was indeed a pioneering year in the shaping of Ireland’s democracy, through the introduction of this now soon to be defunct system of local government. That same system, which indeed from its very conception had many initial defects, some of which were improved with the passage of time, and same has stayed with us right through the founding of our new democratic Irish State in 1922, right up to present date.

One obvious new change of course now is the ending of the hugely powerful post of County Manager, latter added to our Irish system originally around the 1930’s, in an attempt to tackle that daily hated unit of language ‘corruption’. As we now know this addition failed in many respects nationally e.g.planning, however same post is now to be replaced into the future, by a Chief Executive officer.

What we can immediately perceive in this new Local Government Reform Bill, are two major changes; one being the reduction of elected Councillors nationally, reduced from currently some 1,627 or so individuals down to around 949; the other the reduction of course in the number of Town Council groupings being dumped on the WEEE heap; down from 114 to just 31 in total.

Townslands included in our Electoral Area of Templemore / Thurles 2014

Thurles will remain the capital of our ‘neck of the woods’ or Local Electoral Area of Templemore/Thurles, offering nine new jobs to cover the townslands of (in alphabetical order); Aghnameadle, Ballycahill, Ballymurreen, Borrisnafarney, Borrisnoe, Borrisoleigh, Bourney East, Bourney West, Buolick, Clogher, Drom, Fennor, Gaile, Glenkeen, Gortkelly, Holycross, Inch, Kilcooly, Killavinoge, Killea, Kilrush, Littleton, Longfordpass, Loughmore, Moyaliff, Moycarky, Moyne, Rahelty, Rathnaveoge, Roscrea, Templemore, Templetouhy, Thurles Rural, Thurles Urban, Timoney, Two-Mile-Borris and Upperchurch.

Templemore/Thurles 2014 Local Election Candidates

Fianna Fáil: Michael Smith, Seamus Hanafin, John Hogan, Jackie Cahill.

Fine Gael: Michael Cleary, Joe Bourke, Michael Madden, Maura Bourke, Liam Brereton.

Sinn Féin: Joan Delaney, David Doran.

Labour: John Kennedy, Shane Lee.

Independents: Evelyn Nevin, Michaél Lowry, Willie Kennedy, Eddie Moran, Jim Ryan.

Let there be no wailing, periods of mourning or even gnashing of teeth for those who will lose their seats under Hogan’s new Local Government Reform Bill. Despite their claims of having ‘strong voices,’ most have been double jobbing, so none will be forced immediately to emigrate in search of work in Australia or Canada. Instead these same so-called strong voiced representatives, many in the past demonstrating limited ability, will now share a €20.9 million kick-back when town and Borough Councils are abolished at the end of this month. At least we know that these individuals,despite being made redundant, will be able to pay the first round of Fine Gael’s non-metered water tax imposition on time come January 2015, while many of the rest of us will be reduced to “the trickle.”

Politician. (Definition): A person who shakes your hand before elections and once elected, your confidence later on.

After this election, Councillors chosen will discover that they will have very limited power or even that four lettered word ‘work’ to actually undertake. Local democracy as such has been eroding slowly since the vote catching ‘Rates Abolition’ of 1977. These newly elected officers, that you the people will soon choose, will no longer have any control over; Roads, Water Quality, Health, Local Housing, Education, Transport or even Community Development projects, into the foreseeable future. So my next and obvious question; what exactly will these new Councillors be doing for the next five years?

Motor expenses will most certainly increase due to the mileage distance factor, as they alternate between Nenagh and Clonmel. I still cannot understand why Thurles, the halfway house, wasn’t chosen as our Councils new political headquarters.

As our daily readers are aware dictator Phil Hogan is not numbered amongst my friends on Facebook and I make no claim to being a clairvoyant, but from the current financial perspective of our nation, latter “up to its eyeballs in debt,” all this change just may be positive; including the decision to have single unit administrations introduced here to Co. Tipperary for the first time. But again I ask the question what will our newly elected representatives be actually doing and will local democracy in future, be down to the ordinary people on the street violently protesting, as is the case with Irish Water and their metering ?

In the words of President M.D.Higgins, while on his recent British State junket, I also would like to comment on behalf of “the ordinary people of Ireland, and the generations yet to come.” So to this end would each of the above named candidates now seeking election (If I have left anyone off my above list, God forbid, do let me know), like to tell our readers what they have actually achieved on behalf of the Templemore/Thurles electoral area, during their previous term in office.

Remember, I seek information on what each of you achieved, realized, attained, brought to fruition, pulled off, actually accomplished or fully completed, on behalf of ‘the ordinary people’ who placed you in high office.

We ‘the ordinary people of Ireland,’ do not want to hear, I repeat; “We do not want to hear” what you discussed with “strong voices,” or about the work achieved by your political party colleagues in government, which you “welcomed.”

Like any large employer seeking good quality employees, we the ordinary people in this case the ‘Hirers and Firers’ would like to see your Curriculum Vitae (CV) and your References from your last places of employment.

All this information is important to us when we go to decide on whom we should employ on May 23rd, thus ensuring that we can return to office, only those with real proven ability. Forget from which Political Party you hail, Local Elections this time out should be about real ability and keep in mind National Elections are only months away and based on the performance of our current North Tipperary National Elected Representatives, there will definitely be promotions in the offing.

No,no, please, we don’t want to hear about potholes filled, charity fund-raising, car parking charges, assistance given to persons in search of false teeth, glasses or indeed the public funds siphoned off to sports clubs and residents associations to gain local votes prior to this election.

No we want to hear about your efforts in stimulating job creation, tourism, that sort of thing, stuff about supporting local business and inspiring entrepreneurial efforts, where no kick-backs were sought or indeed offered.

Looking forward to hearing from you all very soon.

“The same amount of water has existed on earth for 2 billion years; today only 1% is accessible – fit for human consumption.

Water is a human right. No one owns water.” Trócaire.

Briquettes The cabinet meeting today has ended without any agreement on: Water charges, the associated expected Standing Charge or any person’s ability to pay or indeed the expected costs for each householder. A special cabinet meeting however could now be convened over the coming days if advisors from Fine Gael and Labour can reach a final deal.

Local election candidates in the business of knocking on doors seeking re-election here in Tipperary are, so far at least, more inclined to shove their election literature, marked “Sorry we missed you,” through letter boxes rather than engage in any real dialogue with their voting public. (Then again, at my age, I could be going slightly deaf.)

But one thing is for sure, the fight back by angry working class residents opposed to paying for a basic human right has begun to gather pace throughout the country and one must wonder will this new ‘workers revolution’ just end there.

All of the media chat over the past weeks has been about water charges and jailing of bankers, but from tomorrow, changes to our carbon tax rates are due to take effect.

The application of the carbon tax to solid fuels i.e. coal and commercial peat (mainly peat briquettes and some turf products) will mean, from tomorrow, May 1st 2014, an increase in price of €1.20 – €1.30 in the case of coal (1 x 40kg bag) and 26 cents in the case of a bale of briquettes, based on current prices.

The Fuel Allowance, a payment made under the National Fuel Scheme to assist with home heating and payable to people on long-term social welfare payments, will continue to be paid at a rate of €20 per household per week over a 26 week period in 2014. This means that this assistance applies for half of the year, with the budget for the fuel allowance for 2014 estimated at €208 million.

While those in receipt of long-term social welfare payments genuinely do need this assistance, one must also look at the plight of those working full time on the minimal pay scale. Two 40kg bags of coal, the minimum required per household to keep warm, will now add an extra cost of €2.40- €2.60 per week at least and over this same 26 week period, €62.40 – €67.60 from their pay packet.

Carbon Tax was a measure introduced in Budget 2010, with its application to solid fuels being subject to a Ministerial commencement order. It was postponed in 2012, given the overall major tax increases in Budget 2012, but you can now add this new Carbon Tax cost to our proposed Water Tax costs.

Last week Taoiseach Enda Kenny stated that ‘Water Charges’ would be the last of the taxation burden to be implemented on the Irish people.

In 2008, it was Mr John McGuinness TD, once Social Protection.’ In 2008, it was Mr John McGuinness TD, once Social Protection.’

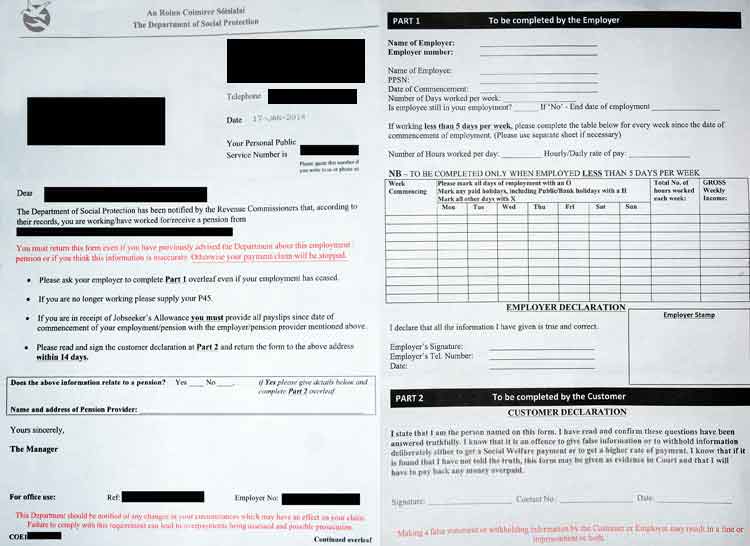

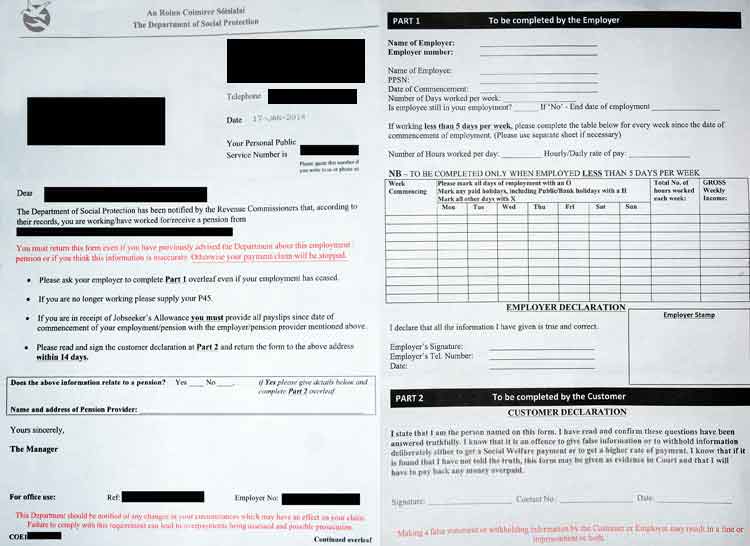

The recipient of our letter is a male aged 21 years, holding recognised University qualifications, who unfortunately like so many Irish born individuals is currently in receipt of €100 weekly, as an unemployed person residing in the State. To retain issues of privacy we now refer to this individual as Pat.

Pat has to the complete satisfaction of an accountant, supplied full documentation in every respect to The Department of Social Protection, from which he currently receives his assistance here in Tipperary. Since October last Pat has only been employed for an eight weeks contract, on a minimum wage for 18 hours per week, to enable the setting up of a new retail business venture. His employer has made full returns to Revenue as required at years end, the true facts therein, thus generating this nonsense and lazy double check.

Implications In The Coming Weeks For Small Business & Thousands Of Unemployed

The document shown above was posted in Dublin city yesterday, postmarked 23/1/2014, at a cost to the taxpayer of €0.60 and received mid-day today. According to the date on the content of this communication, it obviously lay in an ‘Out Tray’ on some public servants desk for five days, before someone ran it through a franking machine and dropped it in a post bag.

Note: According to a female public servant at the Tipperary Social Protection Office and who refused to check Pats file, she claims that thousands of these letters have been already posted or are about to be posted to recently unemployed people, over the coming weeks. Same must be completed by employers supplying all necessary documentation sought.

The text of this letter states; “The Department of Social Protection has been notified by the Revenue Commissioners that, according to their records, you are working /having worked for/received a pension from ….

(a) Click on picture above for larger image and note that 3rd line of page one, names the last employer, and now blacked out.

(b) Part one, on page two, require the employer to confirm remuneration details paid to short contract employees, confirming details already supplied in many cases to Social Protection on termination of this contracted employment, thus doubling the workload on these employers.

(c) Since the original communication was delayed some six days prior to issue, based on the date shown on the letter, unemployed persons now have only 6 working days to respond to Social Protections request. Pat has been informed by his last employer that he must wait until time permits their accounting officials locate and copy payslips and time sheets.

(d) From our unemployed man’s point of view, who has already confirmed all of this information, two other issues now arise;

- Will he be cut his €100 if his previous employer fails to provide yet again this required information on time?

- Will he have enough money to attend an interview in Kildare in 12 days time for which he must expend €50 of his unemployment income in travel expenses, to attend?

(e) Since, as stated, Pat is aged 21 and has only worked six weeks in his entire life, how could he be accused of being in receipt of a pension?

One cannot feel but genuine sympathy for the Minister for Public Expenditure and Reform, Mr Brendan Howlin and Minister of State, latter with responsibility for Public Service Reform, Mr Brian Hayes, as they both now attempt to implement overdue reform on a specially protected and over paid organisation controlled by unions who in turn protect deliberate daily incompetence, latter which is begun at the highest level and is silently sanctioned by other servile supervisors through the downward chain of command.

We invite your comments please.

Johnston Press, the publisher of over 30 regional newspaper titles, including our own county-wide and much enjoyed ‘Tipperary Star,’ ‘The Nationalist’ and ‘Munster Advertiser,’ latter all based in Thurles and Clonmel, have confirmed that they are in talks to sell-off all titles held in the Republic. Johnston Press, the publisher of over 30 regional newspaper titles, including our own county-wide and much enjoyed ‘Tipperary Star,’ ‘The Nationalist’ and ‘Munster Advertiser,’ latter all based in Thurles and Clonmel, have confirmed that they are in talks to sell-off all titles held in the Republic.

These newspaper titles also include the ‘Limerick Leader,’ ‘Donegal Democrat,’ ‘Leinster Leader,’ ‘Kilkenny People,’ ‘Leinster Express,’ ‘Leitrim Observer,’ ‘Longford Leader,’ ‘South Tipp Today’ and the ‘Donegal People’s Press.’

In a statement in the last number of weeks to the London Stock Exchange, the company have stated that it was holding discussions about the possible sale of these titles for an asking price of some €8.5 million in cash, but, however to date, state there has been no decision to agree a sale with any interested party. One possible future interested purchaser is understood to be Mediaforce, an advertising agency that has close links with the regional press in both Britain and Ireland and owned by British millionaire Malcolm Denmark.

Having previously taken the decision to close the ‘Offaly Express,’ the parent company, as part of their cost cutting measures, has announced a group-wide voluntary redundancy scheme. The company has already laid off almost a quarter of its workforce between 2011 and 2012 and merged a number of senior posts in its Irish operation.

Recent accounts for Johnston Press Ireland show that its pre-tax profits fell by some 44%, from €1.7 million to just €941,000 last year. It is noted that in the height of the boom in 2006, its pre-tax profit reached €13 million. Accounts show that the Republic based company also incurred one-off redundancy costs of some €757,000 in 2012, rising from €125,000 in 2011.

What do you, our readers, find missing from your local newspaper, keeping in mind that local newspapers play a valuable role in all local communities? Your local newspaper is still today the most reliable source for reporting local crime, local government activities, local school activities, local politics, advertising of local jobs, commenting on local community/neighbourhood events, local arts events, not to mention being a reliable historic archive for future generations.

|

Support Us Help keep Thurles.info online by donating below. Thank you.

Total Donated 2024: €400.00

Thank You!

Daily Thurles Mass Livestream

|

Recent Comments