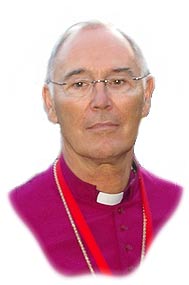

“Banks in the retail sector, who continue to refuse to perform in a socially responsible manner, should have their licences revoked,” stated the Church of Ireland’s Archbishop of Armagh and Primate of All Ireland Alan E. T. Harper, OBE, at the Church of Ireland’s three day Synod, which began on Thursday last and was attended by many C of I clergy from Co.Tipperary.

In his Presidential address, Archbishop Harper stated:

“The consequences of recession are devastating for those forced into unemployment or faced with the collapse of their Companies. I recently received a letter from a GP. He described what he encounters in his consulting rooms as a result of families stressed to the limit by pressure from their banks: decent folk, pillars of the local community, reduced to tears. That GP’s observations are more than supported by the statistics of suicide in both jurisdictions.

I have no special knowledge of banking practice except the experience of being a member of a single income family throughout my working life of 45 years. I know what it is to bump along the bottom and to have to depend on an understanding bank manager in a crisis situation. I know what it means to enjoy the generosity of family and the understanding of friends. What concerns me now is the extent to which things have changed.

The effects of the restriction in bank lending have been disastrous for small and medium sized businesses, especially in the construction sector, and, consequently, for those made unemployed as businesses contract. Many employers have been forced to the wall; one long established firm I know has laid off 60% of its workforce, others have ceased trading altogether; punitive rates of interest, in some cases more than 5% above LIBOR, are being demanded; banks are reducing overdraft facilities; asset rich but cash poor businesses, often described by the banks themselves as their core customers, are being starved of the cash required to enable them to trade, yet these same small and medium sized businesses are the backbone of the local economy.

Time was when banks were either investment partnerships or retail banks. Then, starting with Salomon Brothers in the United States in 1981, partnerships were floated as corporations, transferring the risks to shareholders rather than the partners and employees, and blurring the distinctions between two very different types of activity. At this point the strength of the capitalist system in collectivizing the sharing of risk became, it could be argued, a weakness. As the financial sector sought to create more high risk credit and to invent products to spread the risk of investment among an ever widening pool of shareholders and clients, many people became involved in this area of the economy without being fully aware of the risk that they carried.”

To read the full text of Archbishop Harpers very fine address entitled “The Priority of Mission in the Church of God” click here, as it makes for some very interesting Sunday reading by all so called Christians.

Leave a Reply